The process of identifying, assessing, and controlling the risks of a business is known as finance risk management. This discipline overlaps with enterprise risks management and is vital for investors in financial markets and originators and borrowers of structured products. This article will explain more about finance risks management. Here are three examples of when it is important for your business.

Financial risk management involves assessing, evaluating, and controlling possible threats to a business.

Risk management is an integral part of all business activities, including the purchase U.S. Treasury securities and derivatives used by fund managers. Banks also approve personal lines of credit. Options and financial instruments are used by stockbrokers to hedge currency exposure. Money managers employ strategies such as portfolio diversification and asset allocation.

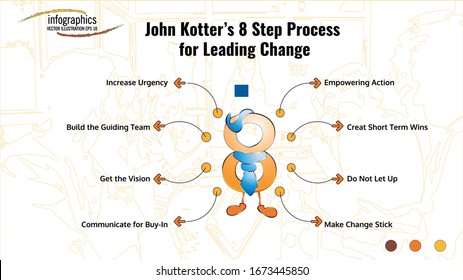

The first step to this process is to identify and address potential risks. These risks can either be internal or exterior to a business. One example is that a technical error or legal liability might cause a financial problem. It could also be due to human error or natural disasters. A successful program for risk management will address all the risks and determine their impact on the organization’s strategic goals.

It is essential for investors in a money market

Money market investors must understand how to manage risks. This requires a thorough understanding of all types of investments as likewise as the cash flows. An effective risk management strategy will ensure that funds supply and demand are aligned. Intangible assets are also an important part of a company's risk management strategy.

Many companies face different risks. These risks include credit and operational risks as well market risks. Finance firms are more vulnerable than other financial firms to these risks. Financial institutions take credit and market risks deliberately, while nonfinancial entities take operational risk as a byproduct.

It is important for structured products originators

In the current environment, structured products originators need to take a more responsible approach to risk management. A way to encourage them is to require them to keep a significant amount of the pool including the senior and junior tranches. This would motivate them to implement better risk management practices and create an attractive portfolio.

A clear example of the importance of sound risk management can be seen in 2008's financial crisis. Structured finance is often blamed as the cause of the financial crash, but poor risk management was what caused the crisis. Problem was not in the products, but in the practices of many financial institutions including banks and mortgage brokers.

FAQ

What does Six Sigma mean?

Six Sigma uses statistical analyses to locate problems, measure them, analyze root cause, fix problems and learn from the experience.

The first step is identifying the problem.

Next, data are collected and analyzed in order to identify patterns and trends.

Next, corrective steps are taken to fix the problem.

Finally, data is reanalyzed to determine whether the problem has been eliminated.

This cycle continues until the problem is solved.

What is the difference between project and program?

A project is temporary while a programme is permanent.

A project is usually defined by a clear goal and a set deadline.

It is often performed by a team of people, who report back on someone else.

A program usually has a set of goals and objectives.

It is often done by one person.

What is TQM?

The industrial revolution was when companies realized that they couldn't compete on price alone. This is what sparked the quality movement. They needed to improve quality and efficiency if they were going to remain competitive.

Management realized the need to improve and created Total Quality Management, which focused on improving all aspects within an organization's performance. It involved continuous improvement, employee participation, and customer satisfaction.

How do you manage employees effectively?

Effectively managing employees means making sure they are productive and happy.

It also means having clear expectations of their behavior and keeping track of their performance.

Managers need clear goals to be able to accomplish this.

They need to communicate clearly with staff members. They need to communicate clearly with their staff.

They must also keep track of the activities of their team. These include:

-

What was accomplished?

-

How much work were you able to accomplish?

-

Who did it, anyway?

-

Was it done?

-

Why was it done?

This information is useful for monitoring performance and evaluating the results.

What are the five management steps?

The five stages of a business include planning, execution (monitoring), review, evaluation, and review.

Setting goals for the future requires planning. Planning involves defining your goals and how to get there.

Execution occurs when you actually carry out the plans. These plans must be adhered to by everyone.

Monitoring is the act of monitoring your progress towards achieving your targets. Regular reviews should be done of your performance against targets or budgets.

Reviews take place at the end of each year. They are a chance to see if everything went smoothly during the year. If not there are changes that can be made to improve the performance next year.

After the annual review, evaluation takes place. It helps you identify the successes and failures. It also provides feedback on how well people performed.

What is Kaizen?

Kaizen is a Japanese term which means "continuous improvement." This philosophy encourages employees to continually look for ways to improve the work environment.

Kaizen is based upon the belief that each person should be capable of doing his or her job well.

Statistics

- 100% of the courses are offered online, and no campus visits are required — a big time-saver for you. (online.uc.edu)

- Our program is 100% engineered for your success. (online.uc.edu)

- Your choice in Step 5 may very likely be the same or similar to the alternative you placed at the top of your list at the end of Step 4. (umassd.edu)

- As of 2020, personal bankers or tellers make an average of $32,620 per year, according to the BLS. (wgu.edu)

- The BLS says that financial services jobs like banking are expected to grow 4% by 2030, about as fast as the national average. (wgu.edu)

External Links

How To

How can you apply 5S to your office?

The first step to making your workplace more efficient is to organize everything properly. An organized workspace, clean desk and tidy room will make everyone more productive. To ensure space is efficiently used, the five S's (Sort Shine, Sweep Separate, Store and Separate) are all essential. We'll be going through each step one by one and discussing how they can all be applied in any environment.

-

Sort. Get rid of clutter and papers so you don't have to waste time looking for the right item. This means putting things where you use them most often. You should keep it close to the area where you research or look up information. You should also consider whether you really need to keep something around -- if it doesn't serve a useful function, get rid of it!

-

Shine. You should get rid of any items that could be harmful or cause injury to others. For example, if you have a lot of pens lying around, find a way to store them safely. A pen holder is a great investment as you won't lose your pens.

-

Sweep. Clean off surfaces regularly to prevent dirt from building up on your furniture and other items. You may want to invest in some dusting equipment to ensure that all surfaces are as clean as possible. To keep your workspace tidy, you could even designate a particular area for dusting and cleaning.

-

Separate. Separating your trash into different bins will save you time when you need to dispose of it. Trash cans are usually placed strategically throughout the office so that you can easily throw out the garbage without searching for it. To make sure you use this space, place trash bags next each bin. This will save you the time of digging through trash piles to find what your looking for.